What is Sales Tax Form ST-3?

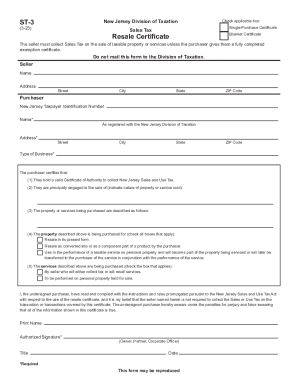

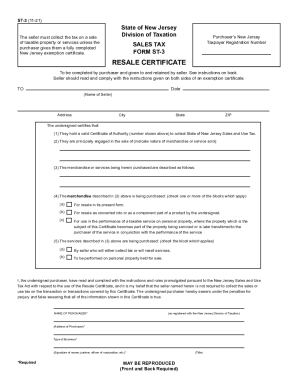

Sales Tax Form ST-3 is known as the Resale Certificate. This application must be filled by the purchaser and sent to the seller. The tax on a taxable property sale must be collected by a seller, unless a certificate for property exemption is provided by the purchaser.

It may be used by the retail household appliance store owners, furniture manufacturers, automobile service station operators, lumber dealers, distributors, retailers and other suppliers. To know more about it, check the instructions to the form.

What is Sales Tax Form ST-3 for?

This form is specially designed for completing when an individual purchases a property for the purpose of its resale.

When is Form ST-3 Due?

You must date the certificate and execute it according to the established instructions. Moreover, this Resale Certificate must be regular and complete in every respect. The due date is not established in this case.

Is Form ST-3 Accompanied by Other Forms?

Basically, this certificate is filed separately. Sometimes, it is necessary to attach supporting documents like employment confirmation, identification documents, and others.

What Information do I Include in Form ST-3?

In the Resale Certificate, you must write the name of the seller the date and address (city, state, ZIP code). After that, you must answer 5 questions that have suggested answers. Just put a tick where necessary. Write the purchaser’s name and address. The document must be signed by the partner, owner or officer of the corporation.

Where do I Send Form ST-3 after Completion?

The completed Resale Certificate must be filled in and submitted to the seller of the taxable property.